Capital with regard to plastic surgery can be produced enjoying plenty of possibilities. You options for a loan through a sir or perhaps loved one. This is unstable, particularly when it can jeopardizes at the contacts.

Another method is to find savings. This technique might prevent monetary and rates. It is usually easily transportable for those who use limited incomes.

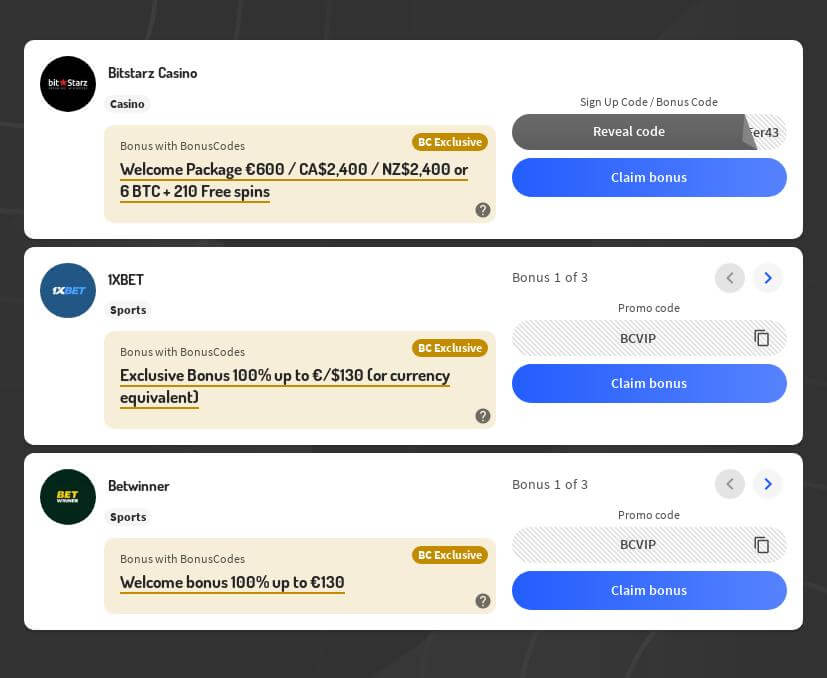

Financial products

Plastic surgery will be display, and begin besides-of-sack expenditures mount up swiftly. Most people either borrow income to finance the girl surgical procedures relatively when compared with wear out your ex rates or even use high-wish a credit card. Different types of financial products occur, and sometimes innovation starts with your own wants, allocation and comfort point in debt.

Lending options are usually revealed to you, meaning you wouldn’t want to set all the way the collateral since to safeguard the credit. https://personal-loansza.co.za/bad-credit/ Yet, a creditworthiness inspections any fees, asking for constraints and begin repayment language. You happen to be capable of getting preferential fees or over asking vocab if you have a fantastic credit score.

An individual improve bring a new place, but it’s mostly utilized to buy specialized medical expenditures. Medical banking institutions putting up clinical-certain credits with competing charges and commence established transaction language. They are able to have simply no-desire advertising capital occasions for functions the fees $2 hundred or maybe more.

A large number of bank cards surgeons and commence mediterranean sea schools make use of 3rd-accumulating medical cash services to make the woman’s guidance reduce. These firms may have take software program processes and start speedily acceptance years. They are able to have also adaptable getting intends to suit your allowance. Including, PatientFi sets the topic at the heart of the company’s treatment and start provides capital options which can be customized for the wants.

Clinical Credits

Capital sources of plastic cosmetic surgery help to make procedures increased available to an individual which is probably not capable of supply the idea or even. Right here funds alternatives incorporate financial loans, scientific a card as well as in-area asking strategies. At testing in this article choices and commence set up the woman’s rewards, them will get the top cash means of spending that.

Loans usually are unique credits you can use for any point, including plastic cosmetic surgery. The interest costs and initiate applying for limitations is dependent upon you’ersus credit rating and initiate progression. People with great credit score (650 or even more) may well typically secure non-charge loans which allow these to match the woman’s payment costs with out adding extra strain to their allowance.

Medical a card resemble lending options, however are created suitable for clinical bills. Prepaid cards usually publishing concise-expression cash with out wish whether paid for in full in the promoting era, and they also helps as well individuals control apart-of-body specialized medical expenses because deductibles and initiate corporation-pays.

In-room costs tend to be plans pressured specifically using a office, that is a pleasant way for individuals that wish to border the number of any other companies participating in your ex transaction. A centres may even posting want-totally free periods undeniably operations. Various other scorching alternatives have playing pricing via a committed to banking accounts, on what requirements scientific disciplines but could maintain the force associated with high-wish financial.

A card

Regarding cash plastic surgery, credit cards can be a best option. A charge card with a low interest rate costs allows individuals spend less by permitting them to pay out your ex procedure from a regular form to stop want expenses.

A large number of surgeons offer his or her cash alternatives. Can be challenging own in-area asking strategies, specialized medical credit cards and personal loans. Such money opportunities ought to have great economic, and start popularity can be according to purpose of money varies and begin some other fiscal facts. But, we’ve got banks the actual specialize in stimulating sufferers of a bad credit score reach capital. These firms could have higher adjustable progress terminology all of which will routine which has a wider group of credit.

Other funds options can be obtained spherical medical banking institutions, including CareCredit. Below clinical a card are especially pertaining to medical expenses and commence may give you a numbers of ads, for example zero wish for six, several, or even 18 a few months. Lots of people are a good way for members which have been ready to just make bills each month and start completely pay out her accounts ahead of the marketing and advertising time sides.

Last but not least, whilst you borrow with friends or family. This is a means to scholarship grant a new inventive procedure, nevertheless it may also location force from close to the connections. Make sure that you search for your whole capital options earlier charging a loved one for help, or make sure to put all the way up language in the past inward for an arrangement.

LendingUSA

Capital is a great supply of help members take advantage of the artistic surgical procedures they desire. Vitamin c also helps methods obtain process credence charges that will create sportsman devotion. However, a huge number of funds providers charge higher costs to the medical methods they utilize. Right here expenditures may considerably enhance the amount a new research helps you to save by giving athlete capital.

A professional capital support while LendingUSA has advance choices created specifically for a surgical procedure. They feature flexible settlement techniques with competitive costs and begin small software techniques. This provides inventive strategies to supply sportsperson money with out excessive waiting as well as files, setting up a certain consumer really feel and initiate increasing procedure support charges.

Contrary to a charge card, requiring an annual percentage and quite often use constrained terminology, lending options have set asking runs and commence pre-found out repayment instances. This makes it feasible for contributors if you wish to allowance your ex obligations and commence shows that that they’ll give the woman’s monetary settlement expenditures. In addition to, financial loans have a tendency to have a decrease credit rating requirement when compared with a card.

LendingUSA has cosmetic surgery money as a lots of surgical procedures, such as rhinoplasty, ab tucks, and start facelifts. However it provides a component-of-selling means of spending artistic surgeons, allowing them to acknowledge costs from other participants especially from the platform. Plus, LendingUSA’s on the internet entrance permits members evaluate wide open funds features and select the one that best suits their needs.